How to Get Rich (Realistically) and Stay Wealthy

The majority of the rich who got really wealthy took calculated risks. They also had the foresight to see things that a lot of us would not be able to see.

Rich people surround themselves with people more competent then them in areas they are not good at.

Most of the time, the wealthy was also able to execute their plans very well. You will also find them having the ability listen to others when it is time to listen. But be steadfast when they needed to.

I got very little of these traits.

And maybe that is why I am not rich (by today’s much higher standards). I worked in a firm where we steward our client’s wealth carefully, so I know where I stand in the spectrum of people who are rich and poor.

But I do think that I have enough wealth for myself though. Enough for me to have a conversation with you on this topic.

The pertinent question on your mind is:

Absent of luck or being born into an affluent status, how do you realistically become rich?

There are a lot of posts out there trying to let you in on this secret.

But there is really no secret.

I read enough money stuff for the past 18 or so years. Having invested my money and built wealth through active stock investing for 15 of those years, I became financially independent and have also written enough stuff on financial independence as a subject.

Most of my friends in the blogosphere became very much richer than when they started years ago by doing roughly the same things as I did. Some of my friends not writing, but building businesses distill it as pretty close to something like this.

We learn from a lot of our firm’s clients that is how they build their wealth and sustain their wealth as well.

The idea to become wealthier than you are now is quite simple. It is just that the information is all over the place. The tactics comes in different flavors but usually around the same point.

So this post sought to help you piece everything together, and add some comments on how I did when it in the Wealthy Formula (I didn’t do well in all areas!)

The General Idea to be Realistically Wealthy is in this Formula

We tackle the money side of things first.

The wealthy formula in a nutshell.

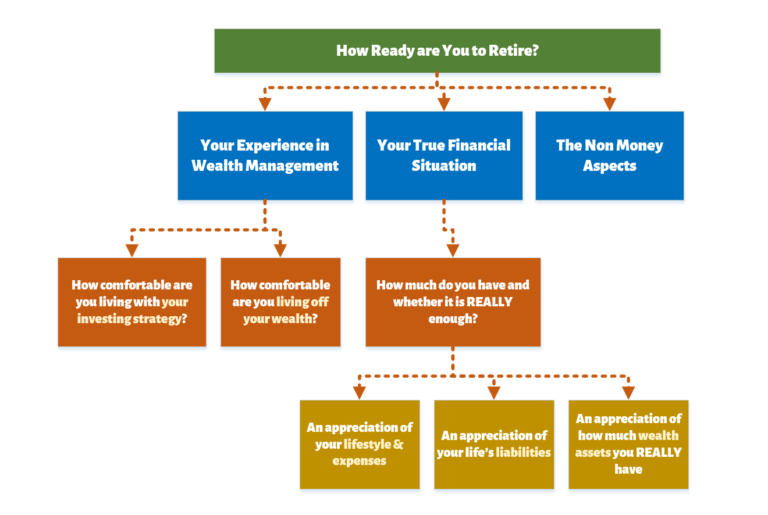

If there is one thing to remember, it is this diagram above. In your life, you will keep doing the things above over and over again.

1. You will increase the GAP or Personal Free Cash Flow

There is this gap between what you earn and what you spend.

We also call this the personal free cash flow. The bigger this gap, the greater your personal free cash flow.

Suppose after tax, I earn $60,000 a year.

My essential expense are the expenses that I need to survive adequately.

This will be

- my meals at home and outside

- meals for my family

- my transport

- phone utilities, home utilities

- home maintenance

- health insurance, taxes.

These essential expenses come up to $20,000 a year. So I have $40,000 a year left.

This is my free cash flow or GAP.

The greater your personal free cash flow, the more deliberate decisions you can make:

-

Spend on entertainment, shopping and rich living. This may enhance your well being. Will not increase your net wealth

-

Pay down your debt. This will increase your net wealth

-

Capital to build wealth. This will increase your net wealth

-

Go for training, courses, higher education. This will increase your future net wealth

You have the choice of spending it on your family, or on yourself or you could choose to delay spending to the future, and deploy your cash flow to build wealth assets now.

In order to build wealth your GAP needs to get larger and larger. Then you can put them in investments to earn a higher rate of return.

To increase your personal free cash flow or GAP:

- Increase your income

- Decrease your expenses

- Optimize #1 and #2

The really smart ones will do #3.

But let me go through them with you 1 by 1 to show you the impact.

1a. Optimize Your Expenses

For most people the expenses are an easy win. They may be unsure if they could get a better salary. A much lower hurdle is trying their best not to overspend.

In fact, they should make good spending decisions.

Buy things that cost more but last for a long time, which you use very often.

For those things that are low in your priority, make peace with it. Spend less on them.

It is OK to indulge in one of your hobby. It is a financial disaster if you have many, many fleeting interests and always spends top dollar on them. They will add up.

Be a value spender. Ask yourself why you really need that something. Find an acceptable grade of the goods and services you need, and try to spend as little as possible to purchase it.

Given the same salary, same salary growth, same rate of return of their entire wealth, the expense optimizer wins out by being frugal.

For many years after I graduated from university, I kept my expenses at slightly above university level. I provided for my family and pay down debt.

Other than that, I do not spend much.

The significance is that my savings rate, is 50%. The typical savings rate for most I know were usually less than 30% more or less.

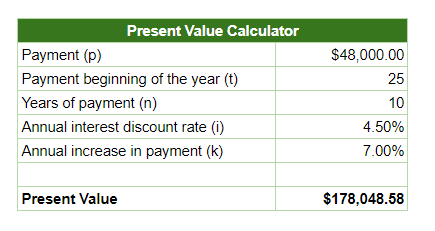

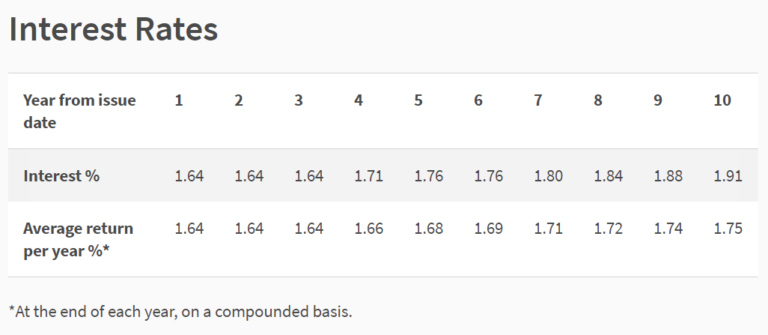

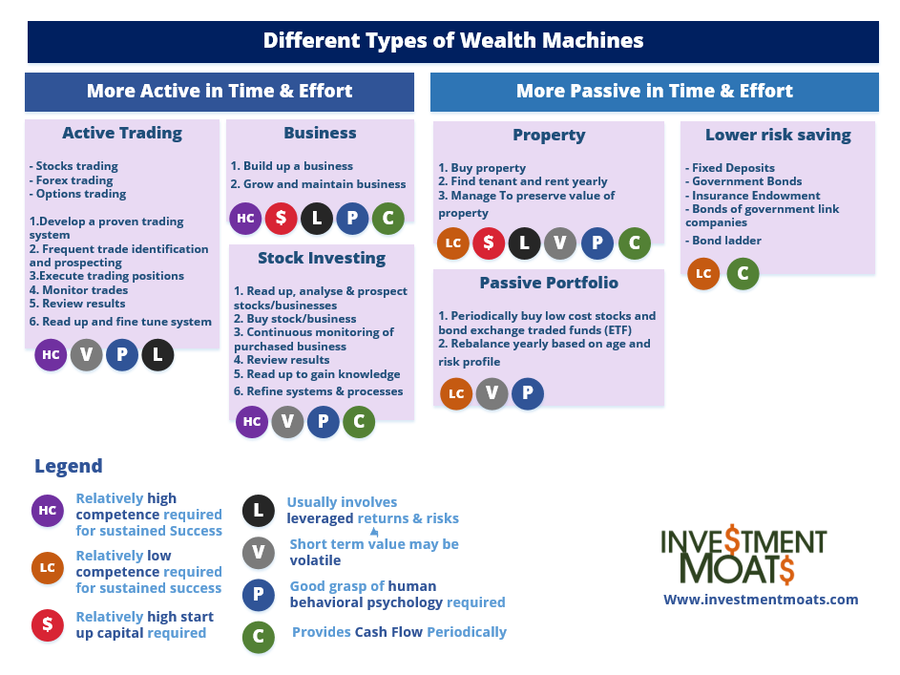

A 50% savings rate vs 10% savings rate (click to see larger table)

The table above compares an expense optimizer, with one that does not optimize.

Because she optimizes her expenses, her savings rate, which is income minus expenses divide by income is 50% versus someone who only has 10%.

The starting investment is $40,000 and the investment rate of return is 4%, her wage growth is 3%.

The net wealth built up at year 30 is $1.3 mil versus $428k. Even in year 5, the difference is almost 3 to 4 times.

Your Savings Rate is the biggest determinant of building wealth at the early stage. Notice that the difference between those who optimize and do not optimize expenses is very big even after 5 years.

1b. Earn More & Higher Income

The other side of the equation is to increase your income.

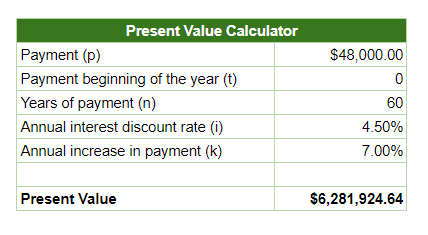

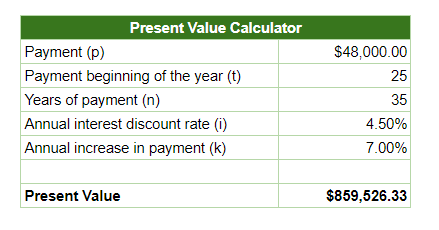

Your human capital is your greatest asset. Your human capital refers to your ability to work, or create a service or business. How much is your human capital? It is the aggregate of all your annual income in the future, adjusted by inflation, back to today.

If you are younger, your human capital would be much greater than a middle age or someone that is older.

But all this human capital is intangible. You have to convert your human capital into wealth assets by putting your personal free cash flow into assets that grow in value over time.

To grow your income, get into a field where there is demand in the future. And it is not a field where it will be obsolete soon. Always strive to improve your competency, add to your experience.

Build up deep competencies in certain areas where

- People are willing to pay you for

- People need it

- what you enjoy or find it acceptable to be doing

- what you can develop deep competency in

Eventually, you may be able to create products and service out of it and become an entrepreneur. You can create a side business out of it. Instead of getting paid for a fixed amount of hours you work, get paid for value you delivered.

A 7% income growth vs a 3% income growth (click to see larger table)

If we compare two persons with the same savings rate, starting income and wealth rate of return, the one that focus on enhancing his or her income growth will build greater wealth.

The person who focus on income growth will earn a compounded income growth rate of 7% a year versus the one who doesn’t (3% a year).

Initially the difference is not a lot. However, after 20 years, the difference start becoming apparent.

Of course, your income growth experience may be different:

- Greater income growth when you are younger

- Higher risk of retrenchment and stagnation when you are older

However, if you calculate the growth of salary over your working career of 30 years, it should be around that range.

My salary growth was not spectacular in the past 15 years. If I annualized my salary growth rate, my salary grew at a compounded rate of 6.6% per year.

The slight difference is that in a matter of luck, Investment Moats became sort of a side business that became income generating. So this adds on to my net wealth as well.

Learn from my experience. Do better here.

2. Build your Wealth Wisely over Time

By increasing your income and optimizing your expenses, you increase your personal free cash flow.

You consistently increased the gap.

As I have said, you have to sensibly convert your free cash flow into wealth assets. And then grow this wealth assets at a good rate of return.

Albert Einstein famously said that compound interest is the most powerful force in the universe. Einstein said, “Compound interest is the 8th wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

Create your own wealth machine that gives you recurring cash flow when you need.

The diagram above is a more detailed version. It shows how your personal endowment fund or wealth machine would look like if you create one. (what are wealth machines).

In this personal endowment fund, you are the investment manager and wealth manager all roll into one.

These are some of the sequence of investment and wealth management actions you will perform:

- You put the personal free cash flow you build up (refer to the Cash from Disposable Income going in) into this wealth machine of yours

- You make the important financial decisions what financial assets you want to put this cash into. Why do you put into these financial assets. When to buy more, hold on to it, and when to sell or re-balance it into another financial asset

- These financial assets

- Grow their value (or crumble in value if you do not do it well) over time

- Pays out interest, rental, business and dividend income over time

-

Keep the interest, rental, business and dividend income inside your wealth machine. Don’t spend it. Reinvest these income into more financial assets

- If you repeatedly do #1 to #4 over time, your wealth machine builds up

- The advantage is that as your wealth builds up, you can sell a proportion of your financial assets over time on a recurring basis. This creates a wealth cash flow that can pay for all or part of your expenses. Or for some emergency spending

You have to make some good financial decisions here. Because if you do not make good decisions, your wealth will shrink. The wealth cash flow will not come in. Too much wealth cash flow is paid out such that it puts stress on your wealth machine.

We will go into more of that later, but first let us see the significance of the investment rate of return of your wealth.

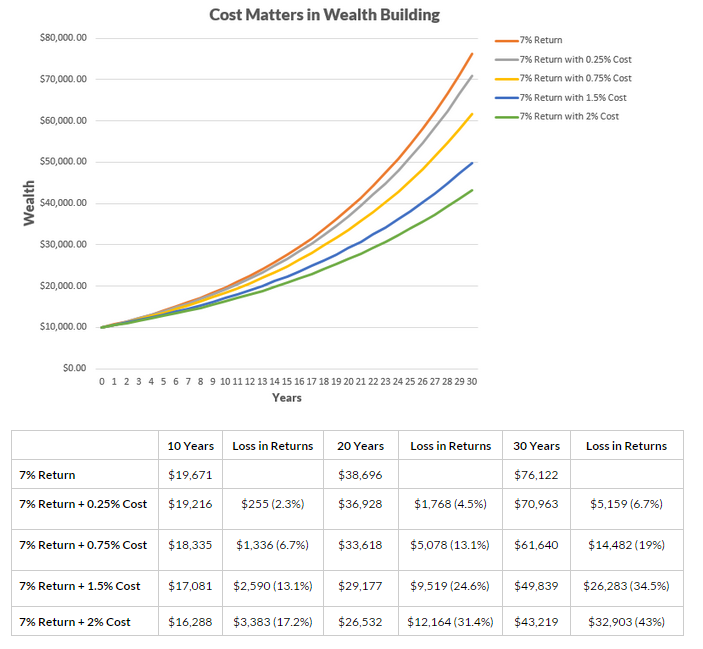

Why your Rate of Return Matters

A wealth builder compounding at 5% versus one that compounds at 1% (click to see larger table)

We have 2 person building wealth at 2 different rates.

Suppose person A focus on building wealth and was able to earn a 5% a year rate of return on her wealth.

Her cousin, person B, thought it is too risky to invest, and put her money in higher yielding deposits that earns 1% a year rate of return.

The result is that after year 15 onward, Person A greatly outperforms Person B’s wealth accumulated.

Here are some more ways to look at it.

Net Wealth growth at different rate of return

If we compare different rate of return, of course the higher will be better. But from what we can see, you won’t see the difference in the first 10 years. You will probably see the difference after that.

The table above shows the growth in these 4 lines in detail. 3% versus 9% at 15 years is like 40% different. So is 0% versus 6%. If you go up to 20 years it is 55-60%. 25 years is 65-75%.

Compounding takes time.

Why you may not be building wealth wisely

There is a need to emphasize on building wealth wisely.

Many of our friends do well by consistently increasing their GAP, but because they are conservative, majority of their wealth is put in savings, fixed deposits or pay down debt.

From my experience, it can be challenging earning 5% a year on your entire financial net wealth or even on your portfolio.

There are a lot of personal wealth destruction going on:

- James boasted to you about making 100% returns

on a few stock gains, but turns out that is just 10% of his financial net

wealth. Overall, it is just a 10% gain. And that gain didn’t last

- James perhaps forgot about the stocks that was

still on his portfolio that are on unrealized losses. He does not dare to take

a stop loss

- Michael took up a course on forex trading. He

thinks that this will give him the edge, prevents him from suffering from

common mistakes amateurs make. He also thinks he learnt some certain tips of

the trade. It turns out that trading in real life, versus simulated accounts,

is very different. He blew up his $20,000 account in less than 3 months,

despite the course. Luckily this is only 30% of his net wealth. The rest of his

net wealth is in cash savings. From his financial net wealth, he is down 30%

- Louis wanted to find a way to invest to beat

inflation. He learns from a Facebook group to invest in a Roboadviser through

exchange traded funds. He contributed for 1 year and there were decent gains.

However, he felt that the returns were “too slow”. Seeing that his friend is doing

quite well investing in real estate investment trusts (REITs), he decides to

sell off the holdings in the roboadviser, and invest in 3 high yielding REITs.

He just happened to invest at an all-time high. The REITs subsequently lost 25%

in value. He got demoralized by the experience. He tells himself he will only

invest when the stock market crash. For the next 8 years he did not invest. He

had a demanding job and could not always pay attention to the market. There

were times when the market was down 15% and that was an opportunity but he was

too busy to take advantage. So he stayed in cash for this whole while. The market

was up 59% during these 8 years

James, Michael and Louis’s experiences are not unique. They

can be rather common.

A lot of the main reasons is due to:

-

Picking the Right Strategy for yourself. There are many financial instruments out there. However, for each, there are a few ways that people attempt to build wealth.

-

Some are sound strategies that give you long term positive expected returns. Some are unsound. There are no clear signs they give positive expected returns in the long run

-

Some strategies take up too much effort of your effort. For some strategies, you need to have your head plug into the financial markets for wealth building to be a success. Usually these are suited for full time investors doing it as their job. This might be right for wealth builders who are interested and willing to make this their second job. However, for those who are busy, it might not be the right match. Most are not willing to take this second job

- Competency. For some strategies, the competency that you require to get long term sustainable positive expected return is low. For some is high. Most often wealth builders underestimate the competency required, and overrate their own competency level

- Behavioral. It is important to use the right financial assets but building wealth is also very mental. A lot of people could not build wealth because they cannot overcome their mental hurdles

So what should you do?

- Build up the financial competency to invest

- Build up the financial competency to manage your wealth

- Find a good financial mentor to learn from

- Find a trusted and competent financial confidant and delegate the wealth building and stewardship of your wealth to them

I do suggest that for some who have build up their GAP #4 is very good. But to know which mentor is good, who can be trusted yet competent, you need to know what you need to know.

That requires some minimum level of financial competency. You have to compound your financial competency over time just like your wealth.

If not you will be eaten alive.

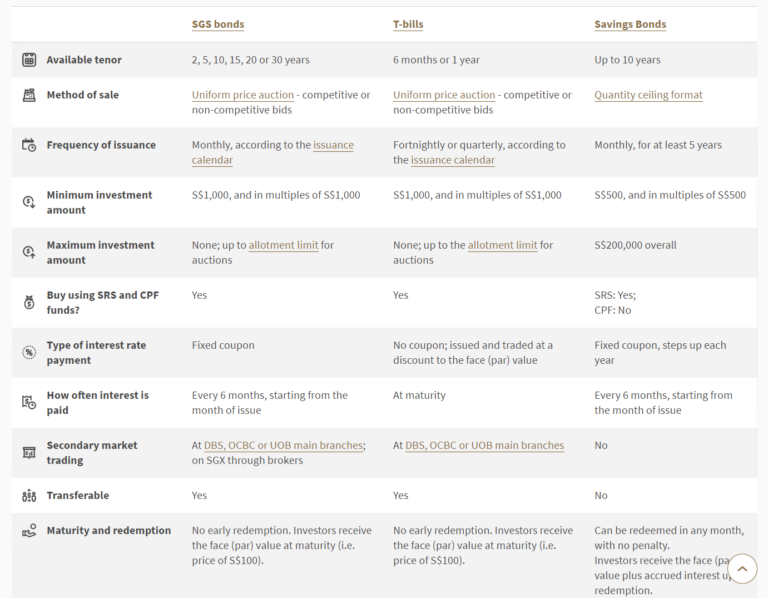

Pick the right wealth building strategy for yourself

In the image below, I listed some popular wealth building strategies.

Different Wealth Building Strategies

Some of them need higher financial competency. Some needs a lot of upfront and recurring time and effort.

I have been an active stock investor for the past 14 to 15 years. I have also started in the unit trust world. So that is where I am familiar with and how I built the majority of my wealth.

For those who wish to build wealth wisely, they can look into build wealth with a low cost, passive portfolio. Select 2 low cost funds that covers the global equity and bond market. Overtime, add the free cash flow or the difference between your income and expenses to these 2 low cost funds.

Bringing it all together: Higher Income, Lower Expenses and Compounding your Money over Time

If you strive to increase your income, optimize your

expenses and build wealth wisely, your wealth will grow in a different way

compared to your peers.

Mary went down this path. Kate took the traditional route.

Mary:

- Savings Rate: 40%

- Starting Income: $40,000 a year

- Rate of return in Wealth Investments: 5% a year

- Income growth rate: 7%

Kate

- Savings Rate: 20%

- Starting Income: $40,000 a year

- Rate of return in Wealth Investments: 1% a year

- Income growth rate: 3%

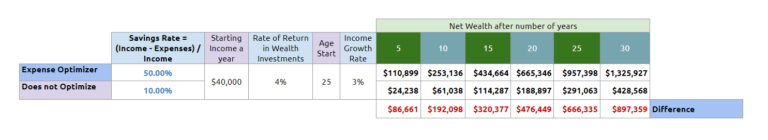

Why Mary did better than Kate (click to see larger table)

Just by growing the GAP and building wealth wisely, Mary ended up with a lot more than Kate even from year 5 onward. In 30 years, the difference is almost $2.2 mil.

You can see that if you just get the basic wealth foundation

right, your wealth will build up.

Had you not come across this and do not know this wealthy

formula, how much you will be missing.

To summarize:

To increase your GAP/Free Cash Flow:

- Increase your income

- Decrease your expenses

- Optimize #1 and #2

Build Wealth Wisely

What Makes the Most Impact to Your Wealth?

John Rekenthaler, head of Morningstar research, wrote a piece on what matters the most to building wealth. In the article (which is behind a paywall) he list down the few ways a person can increase their wealth.

They are:

-

Start early. Find a time machine to go back and start earlier

-

Higher salary. Get a 25% raise to $50,000 a year

-

Salary growth. Grow his or her salary at 4% instead of 3%

-

Increase savings rate. Instead of saving 6% of the annual income, choose to save 8%

-

Increase company match. The company willingly increase how much it matches the employee’s contribution rate

-

Cheaper investment plan. Instead of 0.72% expense, switch to a plan similar but cost 0.22%

-

Better rate of return for your investments. Get a investment that yields 8% instead of 7%

-

Retire later. Wait 2 more years to retire, instead of 67.

John found that some of these make a greater impact to you when it comes to building wealth then others.

Here are the results:

You will realize a few of those that make the most impact, it is also within your control

- 1 – Early start

- 2 – Increase your savings rate

- 3 – Retire later

The rate of return (#6 Better funds) actually is rather small!

Let us look at why.

a. Start Building Wealth as Early as you can

You cannot turn back time.

So this one is more applicable to you young ones reading this.

If you can put away into investing & building wealth as early in your life, you can build more wealth. What many didn’t realize is that you can also put in less capital and get the same result.

The above example shows this.

You have three person Early, Late and Early and Continue:

- Early started early and put in $6000 a year for 15 years then stop. He built up $613k by putting in a total of $96k

- Late started 15 years later and put in $9000 a year and never stop. He built up $598k by putting in a total of $270k

- Early and Continue started early and put in $6000 a year and never stop. He built up $1 million by putting in a total of $276k

Clearly putting in early helped. But if you can keep continue doing it, you will do alright as well.

b. Bump Up your Savings Rate

You can save near 80-100% of your personal free cash flow.

If you divide what you save over your income, you get your savings rate. Your savings rate includes what you put into investments.

The higher your savings rate, the faster you build wealth.

If your income is higher, you can have a greater savings rate. If your income is low, you will have to optimize your expenses. But you can only do so much optimizing.

Savings Rate Difference (click to see larger table)

If we revisit the table where we compare the savings rate, you can see the different is immediately seen at the 5 year mark.

Rate of Return Difference (click to see larger table)

In contrast, the difference when it comes to rate of return is only felt after 15 years.

Your savings rate is more important than this.

For those who are pursuing financial independence for example, your savings rate in this case may matter more than your investment rate of return.

Let us see why.

How your Savings Rate and Rate of Return Matters to your Financial Independence Goal

If you ask me why do we want to build wealth, it is so that we can buy some thing later.

But I feel that a lot of us want to be in a position so that we can choose whether we want to work or not. To do that, we need a stream of cash flow that is able to cover our current annual expenses.

If you have a portfolio of investments, or what I called a wealth machine, you will be able to do that.

We can slowly build up our investments. At first, it cannot produce much recurring annual wealth cash flow. But as we repeat the Wealthy Formula that I explained in this article, your investments will grow. So is your recurring wealth cash flow.

For others, it is less about work optional but to alleviate their financial insecurity. These financial insecurity manifested when they face financial trauma in the past (typically when young). Financially insecure people do not want to have no money for food, shelter and some basic living. They don’t crave for the world. If you are like that, you may just be looking for a stream of cash flow to cover your essential expenses and a little more of the good-to-have expenses. You are seeking out financial security.

How fast can we build up our wealth to be financially independent or secure?

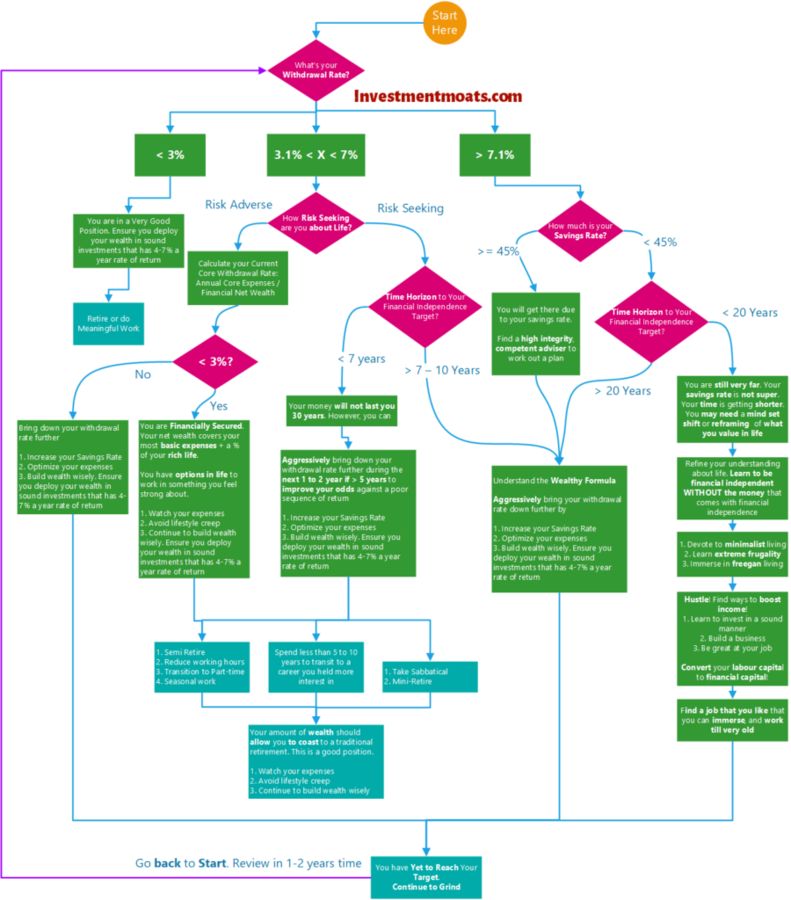

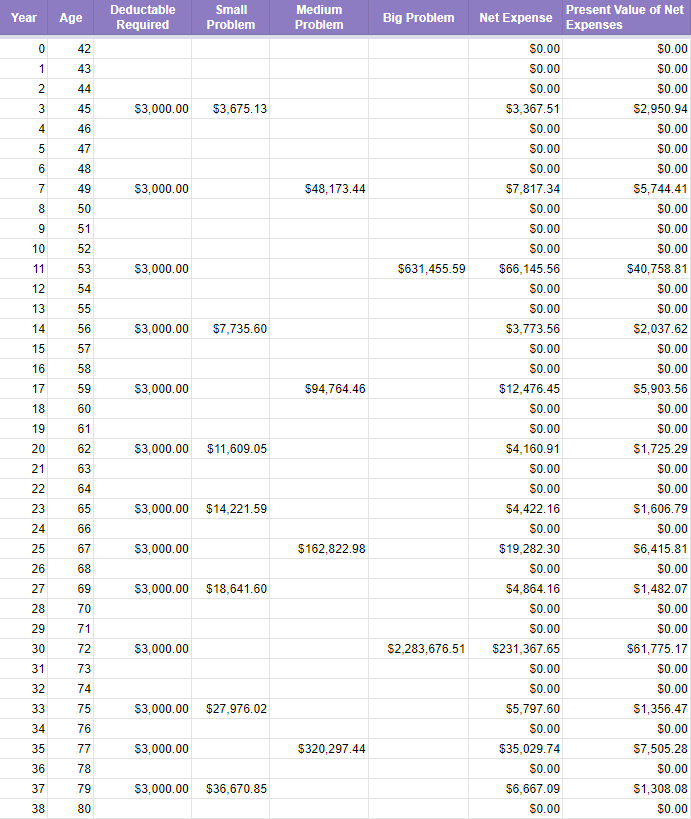

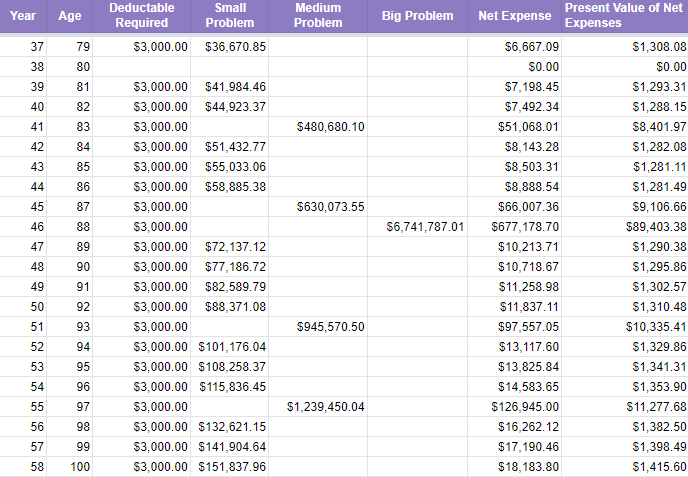

How many years it will take you to be financially independent, depending on your investment rate of return and savings rate

This chart shows the relationship between your investment rate of return versus your savings rate. Observe 8 lines of different color. Each of these lines represent 8 different investment rate of return of 1%, 2%, 4%, 6%, 8%, 10%, 15% and 20%.

On the horizontal axis, we observe different savings rate (% of income channel to Wealth).

This is how it works. Suppose you make $10 from work. If you save 100% of your personal free cash flow of $6, it means that you spend 100% of the other $4. We use the standard 4% withdrawal rate to determine how much wealth you need to retire / be financial independent.

The vertical axis shows the number of years. The smaller the number of years, the faster you get to be financially independent.

Observe that when your savings rate is near 80%, all the lines bundled together. This means that no matter whether your investment rate of return is 1%, 2%, 4%, 6%, 8%, 10%, 15% and 20%, the time you will be financially independent or secure is almost the same.

As you get to a lower savings rate, say 50%, it starts to spread out. But at 50% the difference between a 1% rate of return and 20% is still within 12 years.

For most people their savings rate is below 30%. So the difference in number of years to financial independent is 14 years to 46 years.

Here is another view of the same data:

If your savings rate is high, the investment rate of return matters less. If you cannot jack up your savings rate, you got to take more risk, increase your investment rate of return.

In the illustration above, the solid line are different savings rate but 3.5% investment rate of return. The dotted lines are different savings rate but 7% investment rate of return. Observe that the dotted lines are pretty close to the solid lines.

It is another way of showing that if you want to take less risk with your money, increase the savings rate.

But it is Absolutely Necessary that You Learn to Invest and Manage Wealth Well from an Early Age in order to Stay Rich

The previous section may lead you to conclude that you should focus on earning more, optimizing your expenses, and boosting your savings rate.

That is true.

But at a certain point, your wealth will be so large that the rate of return will be more important.

I realize many might not have grasp this relationship so I explain more here:

- Focusing on Saving More Versus Focusing on Investing: Are you Being Smart about It

- Why You Should Not Force Yourself to Start Investing ASAP

You have to remember this.

To build wealth wisely, you got to invest and manage your wealth well. In order to do that, you need an adequate level of competency.

That level of competency cannot be acquired in a short span. Many thought they could. However, they learn the hard way by losing a lot of wealth along the way.

And it is worse when you lose your wealth when your wealth is substantial, and you have less time to make them back from your job.

Those who paced themselves by learning to invest and manage their wealth, and save well over time is able to manage their wealth well when their wealth becomes more substantial.

Those who Succeed to be Rich Do Two of These Very Well

In project management, we like to say you can only have 2 of quality, speed and cost. You cannot have all three.

What we observe is that you

-

Earn a good income but remained frugal but do not have the time to learn to invest

- Does not have a high income, am rather frugal but you have the time to learn and invest. Most of all, you can earn an above average rate of return

- You are high income and know how to have a high rate of return, but you cannot have the time to budget or control your expenses

There are the rare few that is able to do all three well. But if you do only one of these well, it is likely you need to do that thing very very very well in order to get rich.

If you ask me I would rank myself as such:

1 Very frugal. Relatively less expenses than the standard family. This should be my greatest advantage out of the three

2. Slightly above average rate of return. We usually measure rate of return by either time weighted average rate of return (TWRR) or dollar-weighted average rate of return (XIRR). The first one is hard to calculate but to calculate the second one, there is a quick and dirty method.

My XIRR is about 9-10% over near 15 years including the un-deployed cash in the portfolio. If we measured against others, I do not think this is fantastic investment returns. However, if we measured against the general population, who have made many investment mistakes, or have generally been in low rate of return asset allocation, I think this gives me an edge.

3. My income from work would be average. But as Investment Moats became a side business, it does contribute a little.

For most, you would do very well with taking care of #1 and #3. But you should aim to be rather rounded in #1, #2, #3. Building wealth is not hard as long as you let the time aspect work for you.

How do You Stay Rich for a Long Time

Jaime Townsend knows a thing or two about how the wealthy stayed rich. Jaime helped steward the money of the rich at Lawton Partners Wealth Management in Canada.

Lawton specializes in helping business owners transition their businesses from one generation to another generation.

The one thing that he noticed that allows these people to continue to stay rich was that they manage to passed on the know-how and most importantly, the family values from one generation to another.

When the values are passed down successfully the wealth tends to follow.

You may be building the first generation of wealth, but you can learn a lot from what those that stayed rich in many generations.

We may be wealthy by getting rich fast. This can be due to our luck just having the right opportunity, at the right time. And we did the right thing at the same time.

However, what will make us stay rich is whether you acquire the financial competency to invest and manage your wealth over time. American investor Warren Buffett made most of his money after the age of 70. For most of us, we are considered infants versus that age.

In order to grow wealth, and compounding to work its magic, you need time.

This means that our financial competency needs to show up not just in 1 year but over many years. This cannot happen over night.

If you find your financial competency sorely lacking, make a resolve to build it up fast from today. If not, find someone that is competent, yet trusted to manage it for you.

Summary

This is a long post so let me summarize the formula, in slight detail:

- Grow that GAP or your Free Cash Flow

- Earn more income

- Optimize your expenses

- Balance #1 and #2 out

- Learn to build wealth wisely

- Build up your financial competency to a sufficient level

- Get as great of a risk adjusted rate of return as you can

- Reinvest your capital gains, rental, interest, dividend, business income into your wealth machine

- Learn what makes the most impact to building wealth

- Start investing early

- Boost your savings rate to as high as you can

- Learn to at least do 2 of these stuff well

I cannot promise you that you will be very very rich but this is the most generic, yet realistic way to achieve it.

If you want to get rich quick: Grow that GAP very very fast by getting into sales. That will earn you a lot. Watch your expenses well. Then at the same time, be really fortuitous to be able to build wealth at a greater than 20% a year rate of return.

For those that could not, I hope that this post serve as a guide to show you how to realistic become wealthy over time in your own way.

DoLike MeonFacebook. I share some tidbits that is not on the blog post there often. You can also choose to subscribe to my content viaemail below.

I break down my resources according to these topics:

-

Building Your Wealth Foundation– If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

-

Active Investing– For the active stock investors. My deeper thoughts from my stock investing experience

-

Learning about REITs– My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

-

Retirement Planning, Financial Independence and Spending down money– My deep dive into how much you need to achieve these, and the different ways you can be financially free

-

Providend – Where I work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for first meeting to understand how it works

The post How to Get Rich (Realistically) and Stay Wealthy appeared first on Investment Moats.

True that there’s no “100%”. However, risk can be significantly mitigated if you have a high margin of safety...

Given the increasing reliance on Algorithmic trading models, when the 3 sigma event happens it will be ugly amplified...